guest blogs

-

Scammers Impersonate IRS Agents: How to Protect Yourself from Imposters Trying to Steal Your Money

Apr 23, 2024Scammers impersonating IRS agents use various tactics: claiming you owe money and threatening arrest, offering unclaimed tax refunds in exchange for personal information, or promising tax rebates in return for identity verification. To avoid falling victim to these scams, remember the IRS doesn't initiate contact by phone, email, text, or social media, won't threaten arrest, and won't ask for immediate payment via unusual methods like gift cards or cryptocurrency. If you suspect a scam, hang up immediately, verify the IRS contact information independently, and report any fraudulent activity to the appropriate authorities.Read More about Scammers Impersonate IRS Agents: How to Protect Yourself from Imposters Trying to Steal Your Money -

Ways to celebrate financial literacy with your family

Apr 2, 2024IAA Credit Union partnered with Greenlight, the debit card and money app for kids and teens. In honor of April being Financial Literacy Month, learn why financial literacy is important and 6 ways to teach financial literacy to kids and teens.Read More about Ways to celebrate financial literacy with your family -

Fake Check Scams Online

Mar 7, 2024IAA Credit Union has observed an increase in fake check scams targeting teenagers online. In response, we want to provide parents with information they can share with their teens to protect them from falling victim to these scams.Read More about Fake Check Scams Online -

Spring Break Fraud

Feb 27, 2024Are you gearing up for your spring break adventure? While you're busy making plans, safeguarding against identity theft or fraud might not be your top priority. However, being in a new environment, especially if you're not fully focused on your surroundings, can make you vulnerable. Here are some tips on how to avoid fraud while traveling for spring break.Read More about Spring Break Fraud -

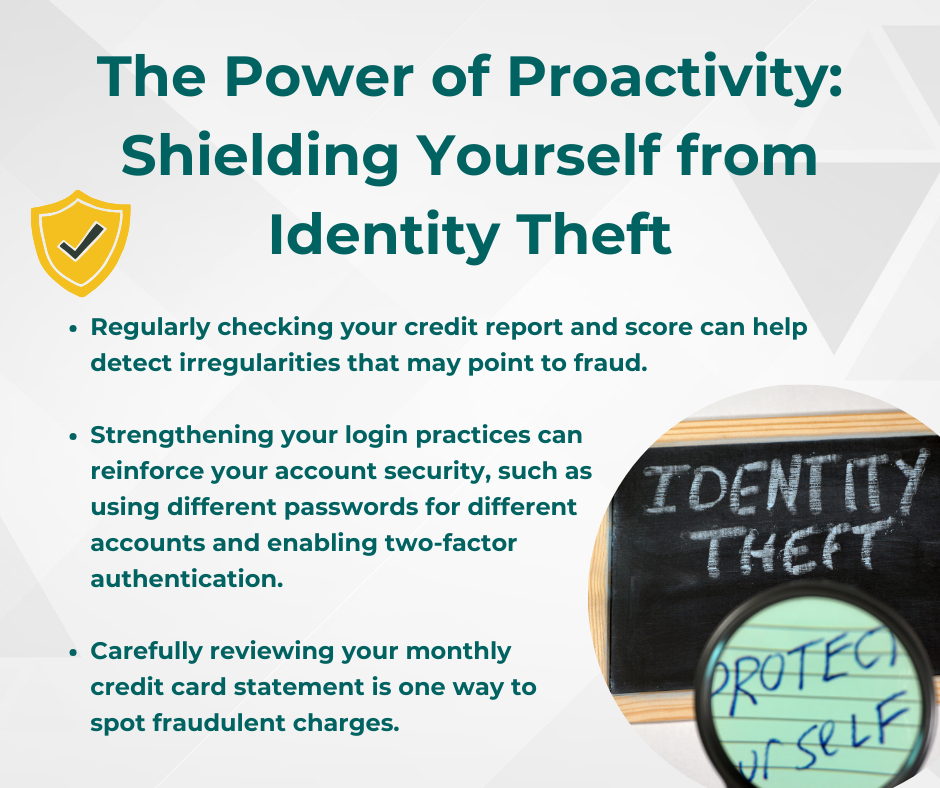

The Power of Proactivity: Shielding Yourself from Identity Theft

Feb 13, 2024In recent years, discussions about information security have become increasingly prevalent. This comes as no surprise, given that data from the Federal Trade Commission indicates a significant rise in fraud-related losses among Americans, surpassing $8.8 billion in 2022—a staggering 30% increase compared to 2021. To shield yourself from fraud and identity theft, consider incorporating these three crucial tips.Read More about The Power of Proactivity: Shielding Yourself from Identity Theft -

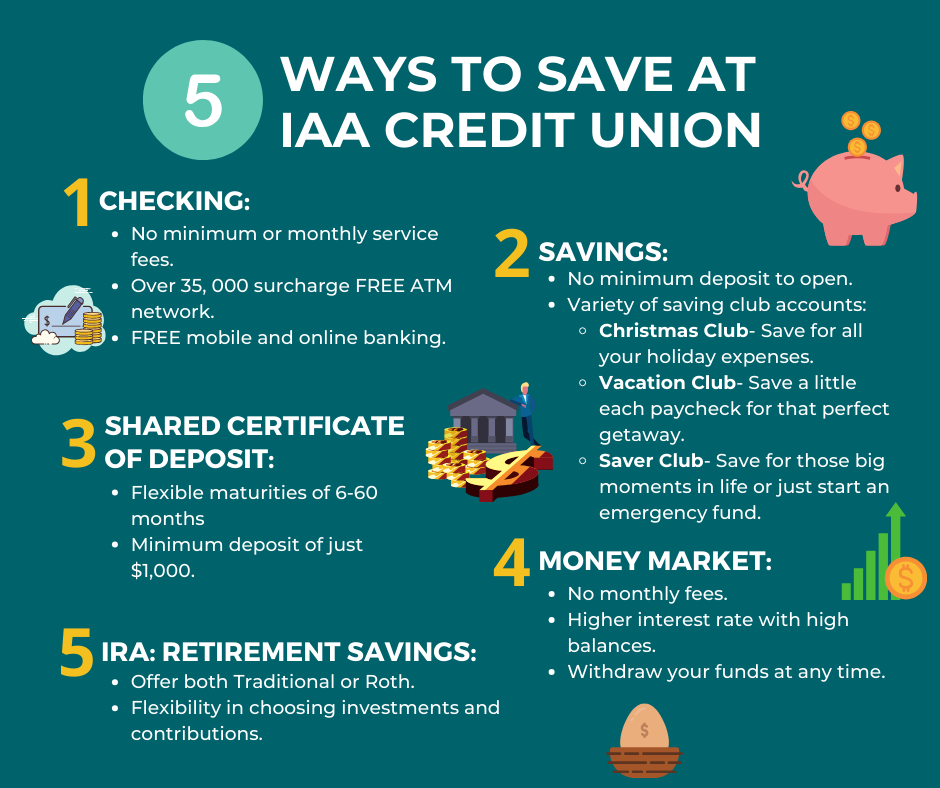

5 Ways to Save at IAA Credit Union

Feb 5, 2024Many of us start a new year with new financial goals that likely include building a better financial foundation for ourselves. Building a healthy foundation involves developing sound savings habits. Building a healthy foundation involves developing sound savings habits. IAA Credit Union offers a variety of savings options to fit all your different savings goals.Read More about 5 Ways to Save at IAA Credit Union -

Romance Scams

Feb 1, 2024Adults of all ages are going online in hopes of finding love and companionship. But seeking romantic bliss online can have a major downside: Cyberspace is full of scammers eager to take advantage of lonely hearts, and their ranks are growing.Read More about Romance Scams -

Navigating 2024: A Tactical Approach to Financial Wellness

Dec 28, 2023As the new year begins, it's an ideal time to evaluate or re-evaluate your household budget...Read More about Navigating 2024: A Tactical Approach to Financial Wellness -

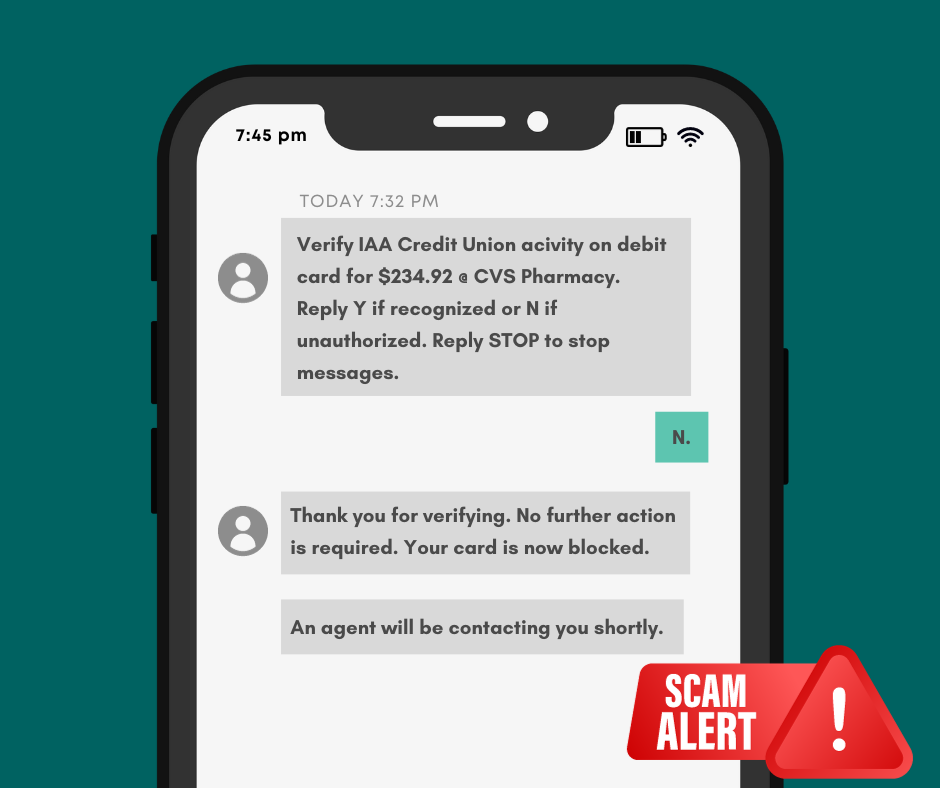

Bank Impersonation Is the Most Common Text Scam: What You Need to Know

Dec 21, 2023Have you ever received a text message from your bank or credit union alerting you of unauthorized activity in your account or the threat of your account being frozen, and the message includes either a link to "reactive or authorize your account" or a phone number to call? If so, you want to think twice before clicking the link or sharing your information as this is a common example of a bank impersonation scam.Read More about Bank Impersonation Is the Most Common Text Scam: What You Need to Know -

From Swipe to Savings: Strategies for Financially Educating Kids Today

Dec 14, 2023The blog discusses the challenges of raising financially savvy kids in today's digital and cashless environment.Read More about From Swipe to Savings: Strategies for Financially Educating Kids Today -

Don't Click on That Text! 5 Ways to Avoid Delivery Scams.

Nov 17, 2023Some consumers have recently been getting text messages stating that a major delivery carrier needs them to "update delivery preferences" on a package by clicking a link. The problem? The text is a scam and the link results in the theft of personal information.Read More about Don't Click on That Text! 5 Ways to Avoid Delivery Scams. -

Seven Tips for Safe Holiday Online Shopping

Nov 9, 2023Safe online shopping is especially important as we head into the holiday season. With the increase in online purchasing, how can you protect your identity and ensure safe holiday online shopping? Here are tips to stay safe while holiday shopping online.Read More about Seven Tips for Safe Holiday Online Shopping -

How to Keep Your Holiday Spending in Check

Nov 1, 2023It can be easy to get overwhelmed when it comes to a season centered around heightened spending - which inevitably leads to the common New Year’s resolution to decrease spending and save money. Consider these three financial tips this Holiday season and get one step ahead on your resolutions.Read More about How to Keep Your Holiday Spending in Check -

Debt Juggling No More: How to Know When It's Time to Consolidate

Oct 23, 2023Managing debt can be challenging, especially when burdened with a substantial amount, and the accruing interest only adds to the difficulty. An effective solution to alleviate this burden is to explore the option of debt consolidation.Read More about Debt Juggling No More: How to Know When It's Time to Consolidate -

Managing Your Household Budget During Inflation

Oct 16, 2023Whether you're going to the grocery store or the gas station, it seems like everything is costing more these days. It’s not your imagination! The question is, how do you manage your money when it takes more of it just to make ends meet?Read More about Managing Your Household Budget During Inflation -

The Savings Account Dilemma: One Size Doesn't Fit All

Oct 10, 2023How many savings accounts do you have? One? Two? Five? You might think you only need one or two, but having multiple savings accounts can be helpful. Here’s what to consider...Read More about The Savings Account Dilemma: One Size Doesn't Fit All -

Don't Fall for SMS Scams: How to Secure Your Accounts

Sep 21, 2023Financial institutions nationwide have alerted their customers about these types of fraudulent calls and text messages. Read about how to protect yourself and your accounts from fake SMS scams.Read More about Don't Fall for SMS Scams: How to Secure Your Accounts -

4 Steps to Prepare for a Big Purchase

Sep 19, 2023A financial journey is filled with challenges such as budgeting, saving, and managing debt, often accompanied by unexpected income fluctuations. Whether it's the milestone of buying a home or a car, these four crucial financial steps can guide you toward your destination.Read More about 4 Steps to Prepare for a Big Purchase -

How to Establish a Credit History

Sep 8, 2023Establishing a good credit record can be difficult for anyone without a credit history. Here are some tips to help you build credit and maintain a good credit score...Read More about How to Establish a Credit History -

Is that really a text from IAACU?

Aug 21, 2023SMS (text) scams are on the rise here is how to protect yourselfRead More about Is that really a text from IAACU?