IAACU Learning Hub

Resources

At IAA Credit Union we strive to build personal relationships that promote smart financial decisions. We hope the resources below help our members expand their financial knowledge and help them utilize our products and services to their full potential.

Plus, check out even more resources from our Partner GreenPath Financial Wellness.

Online & Mobile Banking

IAACU Cards App

Mortgage

IAACU Blog

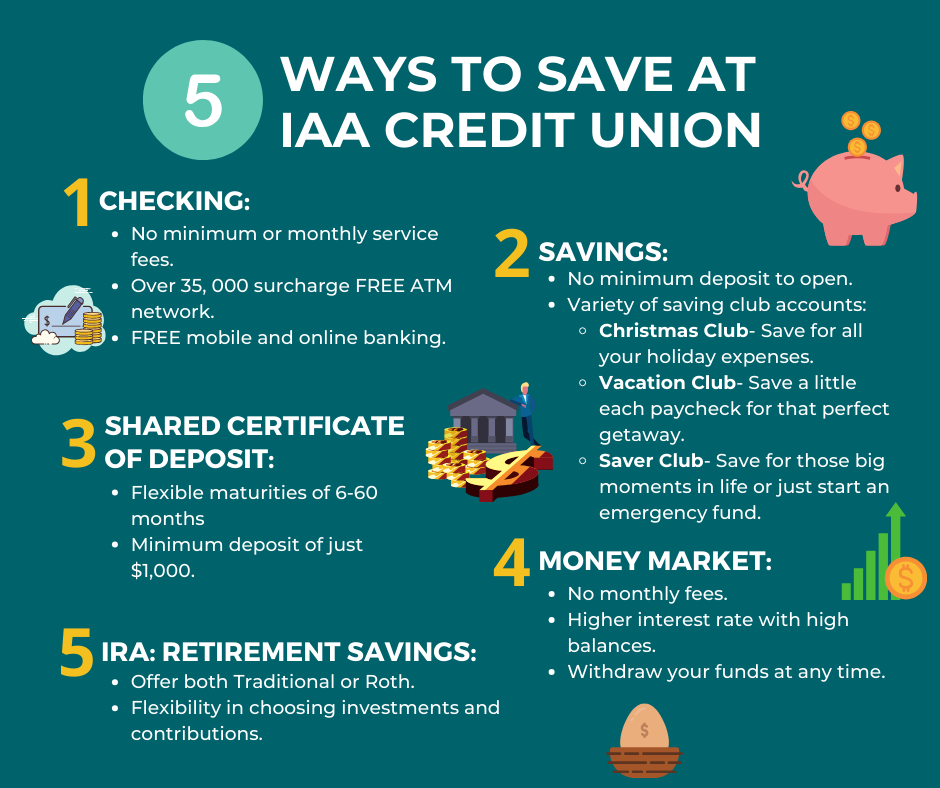

5 Ways to Save at IAA Credit Union

Many of us start a new year with new financial goals that likely include building a better financial foundation for ourselves. Building a healthy foundation involves developing sound savings habits. IAA Credit Union offers a variety of savings options to fit all your different savings goals.

1. CHECKING

IAA Credit Union provides checking accounts without any minimum balance or monthly service charges. Enjoy the convenience of accessing over 35,000 surcharge-free ATMs, along with free mobile and online banking. Upgrade to Platinum Checking for additional benefits such as loan discounts, ATM fee refunds, free remote check deposits, free funds transfers, and access to our Platinum Money Market (see more in Money Market).

To qualify for Platinum Checking, simply set up direct deposit of your payroll or retirement check into your IAACU checking account. Youth members also have access to checking account options with all the same perks as Platinum Checking!

2. SAVINGS

IAACU Savings account is called a “share” account. Every $5 you deposit represents a share of your ownership in the credit union. Primary Share Accounts offer quarterly interest on a balance of $25 or more, $0 monthly fees, unlimited deposits, and unlimited 24/7 account access by internet or mobile device.

At IAACU, we also offer a variety of club accounts such as Christmas Club, Vacation Club, and Savers Club.

- With a Christmas Club, save a little bit each paycheck and earn interest throughout the year. Get your funds on the first Friday in October to help make the holidays less financially stressful.

- A Vacation Club is perfect for your summer adventures whether it’s a family vacation, traveling sports, or even for your summer nanny. Vacation Club account funds are released the first Friday in April.

- Savers Club offers you the flexibility to pick your savings goal and a goal date! A Savers Club is great for building an emergency fund, saving for a vacation, wedding or honeymoon, the car of your dreams, a down payment on your future home, and more!

We also believe that it is important to educate the youth about savings. The IAACU Kids Club encourages practical money-saving skills and helps adults promote financial literacy and the importance of money management.

3. SHARE CERTIFICATE OF DEPOSIT

Share Certificates, commonly referred to as CDs or Certificates of Deposit at banks, offer flexible maturities ranging from 6 to 60 months, a minimum deposit of just $1,000, and dividends compounded daily. Lock in a fixed rate for a fixed period.

4. MONEY MARKET

IAACU Money Market accounts are one of the best liquid investments available! Our rates are competitive with national money market accounts and provide the flexibility of easy access to transfer funds into your IAACU checking account as you need them. Money Markets offer $0 monthly fees, a minimum balance of just $1,000, withdraw your funds anytime, and earn higher interest rates with higher balances.

If you have Platinum Checking at IAACU, you automatically qualify for our Platinum Money Market which earns a higher rate than our traditional Money Market product!

5. IRA RETIREMENT SAVINGS

IAACU offers both Traditional and Roth Retirement Savings. You have the flexibility of choosing investments and contributions. Start investing in your future!

e08dd9fb-d734-44f1-b30a-cc8287ea8489.tmb-vthumbnail.jpg?Culture=en&sfvrsn=4b2c0616_2)

6209e6bc-374e-4e38-a38f-a434b9da8499.tmb-vthumbnail.jpg?Culture=en&sfvrsn=e5ac7324_2)

.tmb-vthumbnail.jpg?Culture=en&sfvrsn=55fe3009_1)

.tmb-vthumbnail.jpg?Culture=en&sfvrsn=adf2a6dc_2)